A war on wealth has begun. In the UK, its the Labour Party’s dogwhistling. Our American cousins face the rise of Alexandria Ocasio-Cortez , Ilhan Omar, Elizabeth Warren’s proposals for a wealth tax in the U.S., and Bernie Sanders’ Modern Monetary Theory and New Green Deal.

In France, they had the Gilets Jaunes, labelling Macron “President of the Rich” as they torched luxury cars and shops on the Champs-Élysées. Then, when France’s billionaires donated their millions to re-build Notre Dame, the same movement criticized them for not donating to other causes. We are in the midst of a war on wealth because of wealth.

The Labour Party’s latest broadcast (below) shows how a billionaire would spend (or not) a tax cut of £20,000 versus how their government would reallocate that money to student grants, pension and wage increases which is then in the hands of individuals to spend in the economy to generate economic growth. It poses the question in its denouement: “Who’s better for the economy. Ordinary people or billionaires?”

Whatever your political viewpoint, it’s not hard to see why someone may be anti-rich. Global inequality, according to a report by Credit Suisse, has increased since 2008’s Great Recession, with the top 1 per cent of global wealth holding 42.6 per cent of all household wealth in 2008. This shot up to 47.2 per cent mid last year.

While this may seem problematic, the rich aren’t to blame for the recession, but central bank policies, in particular the ECB. Witch-hunts find it easy to scapegoat the wealthy throughout history that aren’t easy to comprehend. It doesn’t help when Labour politicians feed these narratives of the wealth gaps, rather than address poverty as the evil, not wealth.

Imagine the scenario: you have built a successful business, played by the rules and made lots of money. The public then decides you have more than you need so decide to rob you of your labours. Because of this threat, many wealth are curbing their ostentation, and keeping a low profile. The rich today try not to look rich, let alone talk about it.

Labour’s Virtue Signalling

The problem with the video besides its tenuous links to economic reality is the tendency to incite resentment toward wealthy, singling them out from the rest of us. All the while, blaming them for the economic issues and claiming they don’t value money: “Oh, that money, I completely forgot all about it!”

A Labour government will re-nationalise economic sectors they think they can manage better, increasing employment and improving pay, reinvesting profits in Britain with no need for these flitting billionaires.

But what would make Labour better placed than the private sector to offer quality services? People are quick to forget the absolute state of them before privatisation. And because we had been protectionist, nationalised for so long they simply couldn’t compete with international competition.

Billionaires employ tens of thousands of people. But why would it be a good idea to keep them situated here in the UK?

Rawls and Picketty to the Rescue

Rawls and Picketty insist on redistributive programmes being implemented in a closed society. Otherwise they would be unsustainable, for instance, exodus of the more internationally-mobile rich. In other words, they have to outlaw tax competition and stipulate ‘Socialism in One Country.’

This doesn’t lift up the poor. It brings down the rich.

For Piketty, wealth seems to be the social evil, not poverty. Poverty has been greatly reduced in recent decades and new money has replaced old amongst the rich.

These narratives of runaway accumulation of inherited capital simply aren’t plausible. That’s the beauty of modern market economics. The maligned rich perform useful functions without necessarily intending to do so.

This idea of wealth statuses being something unearned through rape pillage and plunder in Europe isn’t widely held in the States. And look at the result, we are all in the bottom 3 US states.

Little wonder Labour broadcasts are virtue signaling. Vilifying wealth because of their wealth, with no consideration for causality. No attention to system design under Lemon socialism – privatised gains, collectivised losses.

Ideologically perverse motivations to capitalise on Brexit shambles by the Labour Party. The circulating of funds through the economy with lower taxes for small businesses, struggling entrepreneurs who can then work and employ people will make the difference.

On the other hand, those billionaires who have justly earned their money not by government exclusive contracts to allow for monopolised profit extraction, should be thanked.

Most nations with a developed financial system allow for capable functioning despite debt. Many of the most materially wealthy individuals are incredibly indebted as they fuel their investments (especially in a low interest world) through taking on debt.

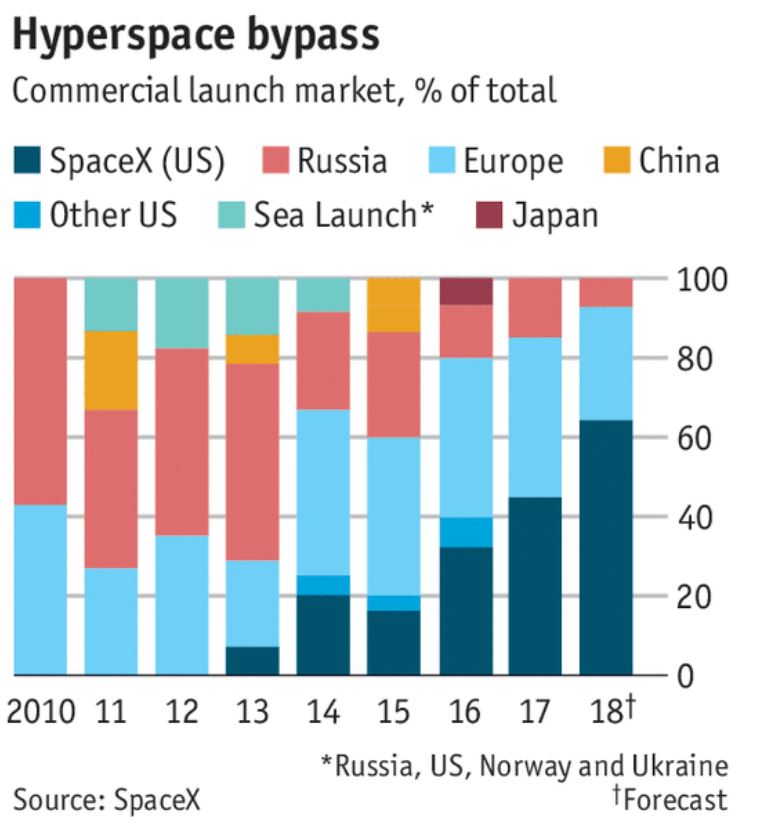

Look at Elon Musk’s vision for electric cars, for 6 years he has borrowed hundreds of millions against his own shares to pour into the vision. And now he’s ploughing everything into Space X to break up the NASA and Russian satellite launching and space exploration industries with free market competition. Effectively putting his competition out of business (had they not government prop-ups for national interest).

These billionaires are like the rail barons of old- burning through their great wealth to pioneer new, exciting industries – driving the human face forwards and creating real wealth through the value they provide by virtue of the fact people are willing and prepared to pay handsomely to reward them.

Take JK Rowling’s Hary Potter (a favourite anecdote of Yaron Brook). People have made her a billionaire because they valued her stories and magical world more than they valued a few pounds here and there. Or the iPhone XS, are people really being coerced by advertising / marketing alone to part with 1200$ or do they believe it will give them more value than their 1200$ in their pocket?

Or the Sam Walton’s with their Walmart’s saving consumers money by driving down prices. Then they have more disposable income to spend elsewhere, or save – I know, a novel concept for Keynesian drones.

The reality is, this mentality makes everybody poorer. And we would end up with a basket case economy where to get ahead of other people power is sought in politics and then they grant themselves exclusive rights to an industry (Brazil) or appropriation of businesses (Serbia).

Much of the western world, with free markets, entrepreneurialism and hard work + significant risk – be it time, capital or taking on loans – are how people get rich and create wealth for others by innovating to solve problems in society that other people are prepared to pay money for.

Wealth is endogenously created and not restricted, despite central bank efforts. My having it doesn’t not decrease the size of the pie available to you as there is no fixed pie. Wealth is not at the expense of others. It can be destroyed though, take Bastiat’s broken window fallacy illustrating why destruction and the money spent to recover destruction is not actually a net benefit to society.

Wealth is created in exchange for creating value. Labour going into products or services only has value if something is willing and able to pay for it. Otherwise, what would you tell the entrepreneur who put in 10,000 hours and didn’t see a single penny? Should we bail them out according to his ability, to each according to his needs?

Trillions of dollars aren’t stuffed in mattresses as the video suggests the billionaire with his tax cut just pockets the money and forgets about it. It’s invested, either via ownership of capital assets or via financial institutions. New businesses are funded creating jobs and products for consumers, or it is used to finance household debt for mortgages and other consumer purchases.

The wealthy often have businesses and ventures themselves. They take in lots of debt to finance projects they believe will generate growth of capital or provide a solution they can sell and make profit.

It could be new infrastructure, technologies or arbitrage opportunities that assist in clearing market inefficiencies more swiftly.

Wealth may nominally be in the possession of billionaires. But its use is restricted to normal economic functioning which demands everyone consume and interact with their wealth. If they did not provide value, why are we parting with our hard-earned cash to help them ?

This presentation of ownership as necessarily exclusionary is largely inaccurate for England.

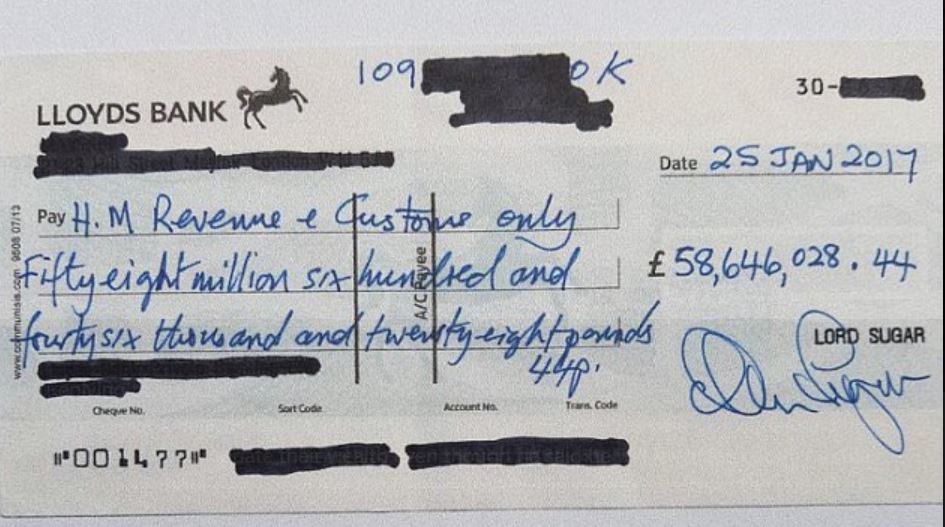

One merely has to look at Lord Sugar’s cheque to HMRC to see what a billionaire who employs thousands does. One of those who the Corbynites said they can’t wait to appropriate their wealth even though he among others like John Caudwell, creator of Phones4U and Britain’s largest taxpayers, said that they will leave the country in the event of a Labour government under Corbyn. If that comes to pass, and it’s not empty rhetoric, those ordinary people in this advert may have to make up the shortfall in tax revenues.

Baseless Agendas Leading Voters up the garden path

The video has lots of straw-man arguments that are somewhat befitting of their agenda. If reality doesn’t line up with your beliefs, just make baseless assertions. It’s rather telling when tax cuts are presented as government giving people money, instead of the reality of them taking less. Unless you remember the taxman working those 40 hours last month with you?

Labour Government: Chief Judge, Jury and Executioner – A Tale of Inefficiency

This notion a government ministry can adequately allocate and redistribute some hand-outs -instead of doing this hypothetical tax cut (corporation tax perhaps) – and this will solve a slowing economy by itself doesn’t hold much water. Money changing hands increasing the flow in the micro-economy is beneficial for providing more liquidity which helps consumer confidence, but it isn’t better for the economy than entrepreneurs and pioneers who create real wealth by solving problems we face through brainstorming ideas and then implementing them. Innovation, then, through taking on risk, debt and working incredibly hard trumps this stagnating, sustain the status quo drivel we are fed by political virtue signalling.

The trouble with this simplistic “tax the rich!” jargon so routine workers can then enjoy a better life is it would encourage stagnation.

If you’re happy sitting where you are that includes being happy with what you’re paid. If you’re willing to be an employee at that wage then great as companies need steady, complacent workers. If you’re not, however, and want more to improve yourself, work hard and promote upwards, then great also.

This idea that some who have bettered themselves, risen through businesses or created their own and are making money can then be taxed sufficiently to have ANY noticeable effect on the average workers quality of life is a mathematical improbability.

There are simply not enough rich people and there are far too many idle people with hands extended to rob them of their earned money, put it in the governments hands where inefficiencies piss away 80% into white elephants and hand out the remaining funds to millions of people. Often providing the funds to attend courses and degrees that don’t teach them the needed skill sets to make them useful for working in businesses. The miss-allocation of resources that allows for people to undertake degrees they wouldn’t risk doing if they had their own £30,000 of capital on the line, instead without any real risk of having to pay those loans back to taxpayers – clean slate after 30 years – is nonsensical.

The reality is, a Corbyn government would want to keep large swathes of the population in their place so they’ll vote for those generous overlords to keep the handouts coming. It’s far more expedient than working for it after all. And the government can keep printing money or plucking it off the magic money tree without damaging the UK’s credit rating. It’s bound to all end in tears and conveniently we can just blame those remaining rich people who stuck it out and continued working hard developing businesses while the rest fled overseas.

The Maths Doesn’t Add Up

Take the top 10 US billionaires. We can assume net income at 5% of their net worth. For instance, Bill Gates takes in ~$4 Billion. Applying this factor across the 10 richest, we have 26 Billion dollars a year.

Now let’s add a new tax to that money. 10% off the top to Government will be 1.3 BN

Now take 321,400,000 American citizens. Assume 60% qualify for your wealth distribution programme with the 40% above rich enough arbitrarily. Some of them may have tried to get rich but failed, tough luck, not enough for everybody.

160,700,000 people have a slice of $1.3 Bn .

Congratulations , you have a life changing cheque for $8.14 courtesy of the generosity of your 10 Richest people that inequality campaigners lark on about.

Oops, sorry. This is before government inefficient handling of the redistribution takes its chunk. 80% is the general rule of thumb for revenues that is consumed by the machine. So 20% left for social programmes. Even if Trump whopper government into shape and we saw 40%. This is a measly $3.25.

We have only taken from the top 10, how about the others? Well, wealth drops off going down Forbes 400 from $80~ Billion down to 1.7 Bn. With far more single digit billionaires than double, median net worth stands at 3.6 Bn.

Doing the same math as above, you would receive $353.25 from the entire Forbes 400.

Now, I don’t know how much more money you think you deserve, but you can see that you would have to work pretty far down the “Rich” lists before you’re going to get to you making another $10,000 a year more. And the case in question in the U.K. with our considerably fewer superich is significantly raiding the upper middle class of the family silver and while you’re at it make sure you get the crockery too.

The simple mathematical answer is, like with all socialist policies there are simply not enough rich people to pay for all the non-rich people’s fantasies. Especially not after glacial bureaucracy and ballooning government inefficiency margins.

Besides, then, creating a system of dependency, it encourages people to be idle and comfortable in their relative poverty. Rather than actively impelling oneself to take personal responsibility and find solutions to problems we all face or get the skills necessary to be useful in the modern economy.

The moralistic answer is why should people expect to be allowed to sit where they are and paid more money that comes from other people who have earned it? Let alone the incredible leaps and bounds for humanity’s benefit those dreamers and high achievers can accomplish without coercive intervention, whether intentional or their part or otherwise.

For Labour’s concept of a magic money tree or this “Modern Monetary Theory” to work, the number of Brits to be taxed would be huge in relation to the number of people receiving the money. Just ask any breadwinner of a household supporting their family, they’ll tell you how hard that is to do. It’s simply not right.

There isn’t generally a good reason why most people can’t make the sacrifices to secure their financial positions.

There’s too much entitlement, impatience and envy in this country and Europe for that matter with an obsession for tales of Robin Hood than the glorious risk – taking of our Atlantic cousin’s Robber Barrons.

The sooner we wake up and smell the coffee, we can move away from this socialism quagmire that has stagnated swathes of the globe for decades, and move away from the true evil ‘poverty’ which has plagued mankind as the naturalised state of nature forever. Innovating our way out of the challenges in the 21st century. But this isn’t how you do that.