About a year ago today WeWork was Wall Street’s favourite darling. Being backed by the like of JP Morgan, Goldman Sachs and SoftBank they raised billions in investment rounds and were valued at $47 billion. However, not too long after cracks started to show, and WeWork’s rapid decline soon followed. There is a lot of discourse surrounding the reasons for their collapse namely, growth strategies, lack of leadership and their inflated valuation.

What is a tech company?

No matter what WeWork claims they are in their annual or global impact reports, it is clear that WeWork is not a tech company despite positioning themselves as one. There has been plenty of coverage on “Why WeWork isn’t a tech company”. In their S-1 filing WeWork mentioned the word “technology” 110 times and chief product officer Shiva Rajaraman told TechCrunch that the company is “moving toward a Google Analytics for space”. Despite this, their organisational structure and their investments (mainly in real estate) suggest otherwise.

WeWork isn’t the only start-up that has been stretching the definition of tech as of late. Companies like Peloton and Sweetgreen may have been able to position themselves as tech companies although their products, services or business models suggest otherwise. The initial growth of these companies at one point shifted what it meant to be a tech company – for an extended period of time it seemed that just using technology to operate was the only pre-requisite needed to position yourself as a tech company.

We are in a digital age where technology is the driving force behind the operations of a company (e.g. subscription management, data analytics, takes online payments) but using technology or the hiring of many software engineers shouldn’t be what denotes a tech company.

It’s more than just semantics

Some of you reading this may think that being positioned as a tech company is nothing more than just semantics, however, posing as a tech company does have its ramifications. A quick look at the valuations of WeWork, Sweetgreen and their competitors (who don’t pose as tech companies) shows the problems with tech companies and their valuations:

/cdn.vox-cdn.com/uploads/chorus_image/image/64043776/zoom_slack_ipo.0.jpg)

- Sweetgreen valued at $1.6 billion – four times as much as Del Taco with 5-times less restaurants.

- WeWork valued as high as $47 billion (now around $3 billion) – ten times as much as IWG plc despite having smaller revenues.

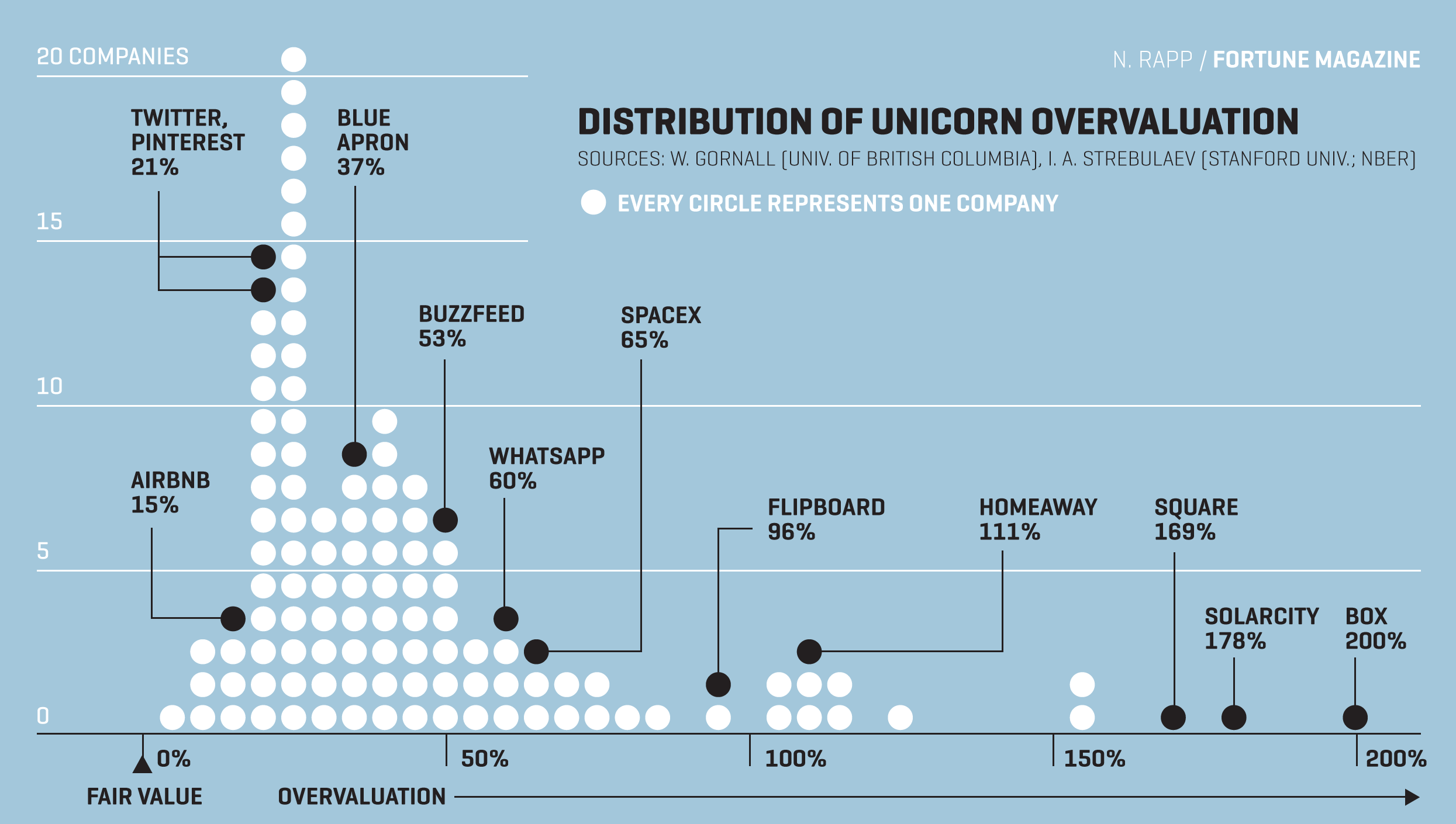

Tech startups are often valued much more than what they are worth, and until recently this was a common practice as investors bought into the brand, or name hoping that it will bring large returns. This inflated valuation could be one of the reasons why a number of companies are posing as ‘tech’ companies.

However, investors are catching on and have become aware of the slipperiness around tech terminology and valuations. Some investors are concerned that this could contribute to an economic bubble; there are indications that this could be the case as the share prices of most tech companies that had an IPO in 2019 are currently trading at a price lower than their opening price.

Responsible Unicorn Hunting

Consumers and investors are keen to find and invest in the next billion-dollar tech company. In this hunt investors (venture capital firms, investment banks etc) have the responsibility of making sure that tech companies looking to IPO have accurate valuations. Making sure that valuations are based on the company’s growth or investment return potential will prevent them from using the terms tech as a way to goose up their value.