”When the Elephants are dancing, stay off the dance floor…”

Old Pool Shark Proverb

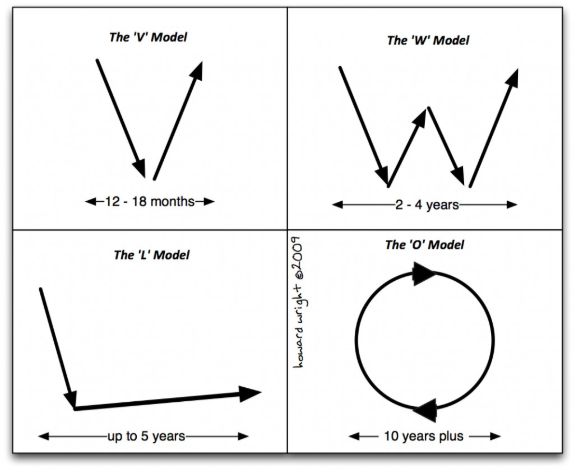

After a ten-year bull run, I’m sure the selling is over after a few weeks. Jack be nimble, Jack be quick and jump back in on those 30% discounts, right?

Trouble is, we never left the bubble because the bubble never cleared. The intervention to prevent deflationary spiral in 2008 prolonged the day of reckoning. Here we go again with the bail outs of failing companies, and unlimited Quantitative Easing, but this time we’re entering currency collapse territory.

Business as usual

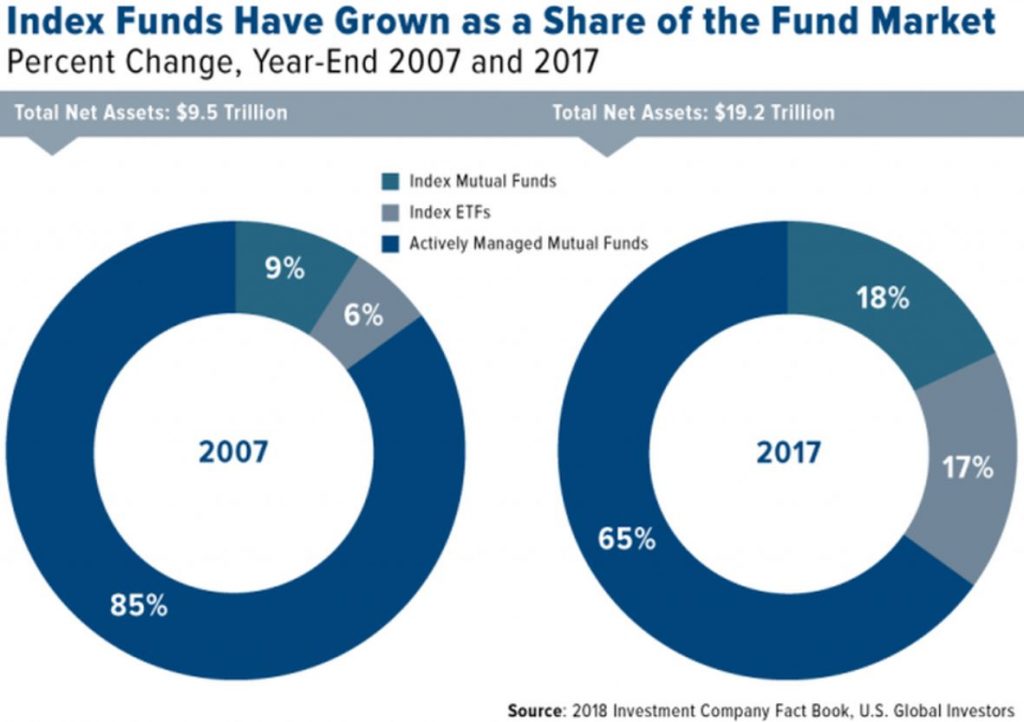

It makes perfect sense for fund managers, after a 1 month fiasco, to rebalance their portfolios back to what used to work. Stocks dipped proportionally to other asset classes, so sell down other assets to reallocate. We get drops anywhere up to 20% every year throughout the history of the markets. Large players step back in to buy the dip. Last Tuesday, stocks posted the biggest dead-cat bounce and short squeeze since 1933. As March came to an end along with the first quarter of 2020, some $850 billion in mandated stock buying took place.

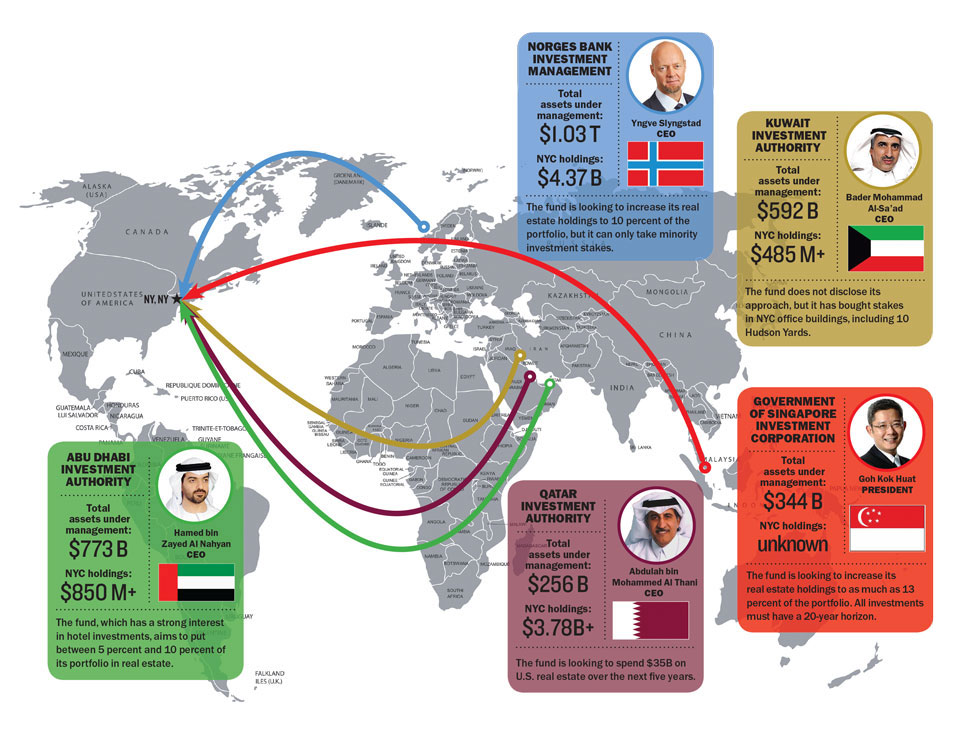

JP Morgan estimates put balanced or mutual funds at 60:40 ratios equities to bonds. Globally, they account for $4.5 trillion and $1.5 trillion in USA. To rebalance to a 60% equity proportion would take $300 billion. Simultaneously, the $7.5 trillion of American defined benefit plans would need $400 billion to fully rebalance to restore pre-coronavirus equity allocations. On top of this, we have sovereign pension funds like Norges bank and Japanese GPIF. Pre crash these had $1.1 Trn and $1.5 Trn respectively. To revert to their target equity allocations of 70% and 50% they need to each purchase $150 billion in equities. The Norwegian Sovereign Wealth Fund announced it had lost $124 billion in the crash and its outgoing Chief Executive Yngve Slyngstad said it would raise its stock market investments back to 70% from 65.3%. While declining to say by when the fund would return to 70% equities or whether any stock purchases had yet taken place during the crash, judging by the rebound, price action shows this already happened.

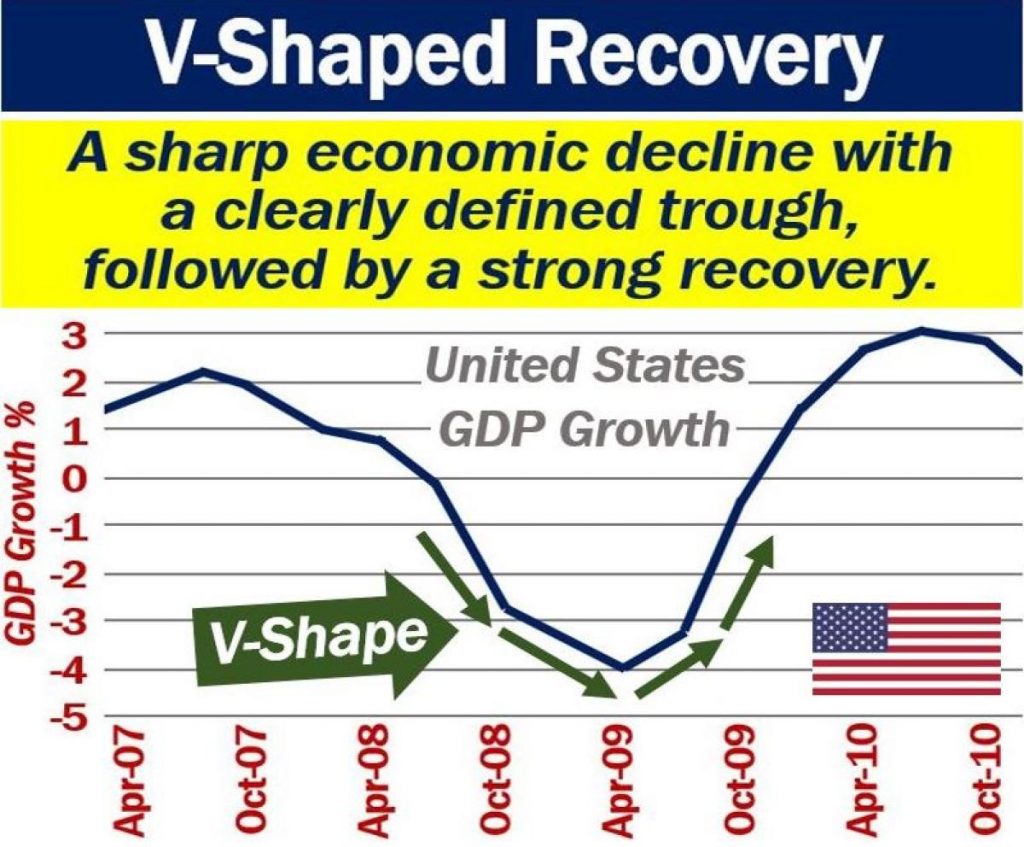

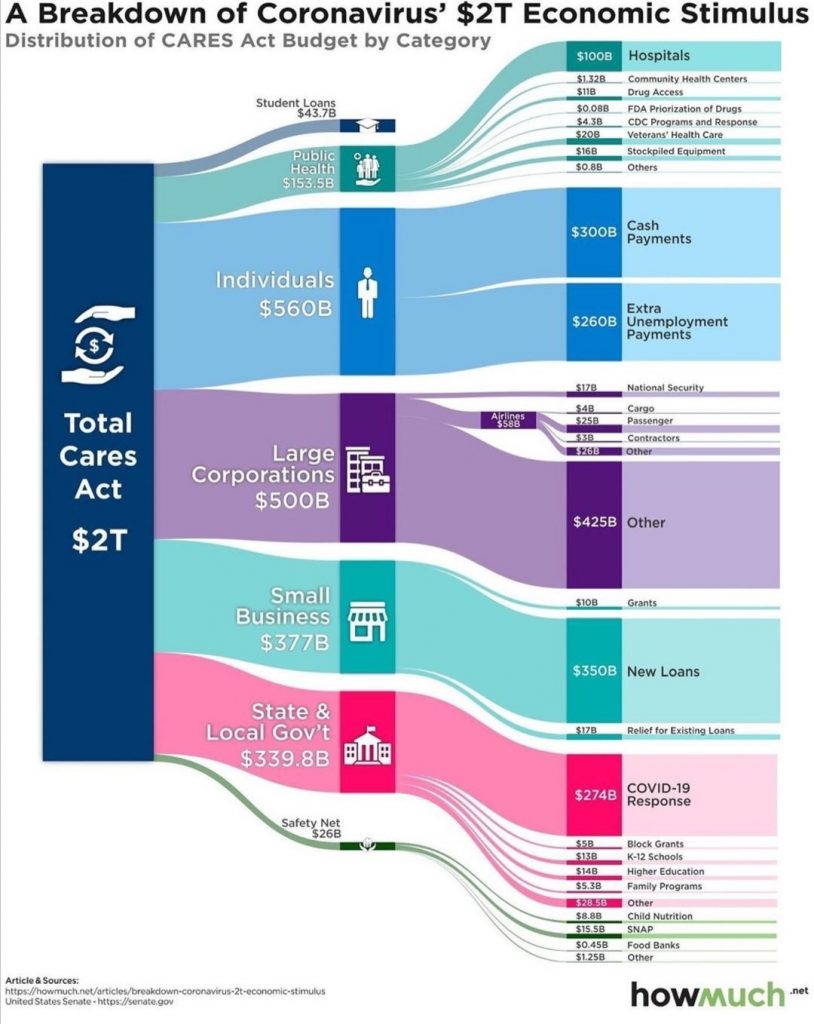

Throw in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act 2020) with the Federal Reserve stepping in as a ‘forced’ buyer coming in at the cash-market open each day last week resulting in an overly pronounced V-Shaped recovery. Forced buyers are funds that have to balance their books to meet by-laws or covenants, i.e. required to own specific asset classes (like stocks) at a specific percentage. In this case, it happens to be the government to prop up the economy.

Before manipulated markets, bear markets ended in panic. I don’t think we have seen it yet. How many people are going to let their retirement continue to evaporate if they haven’t already?

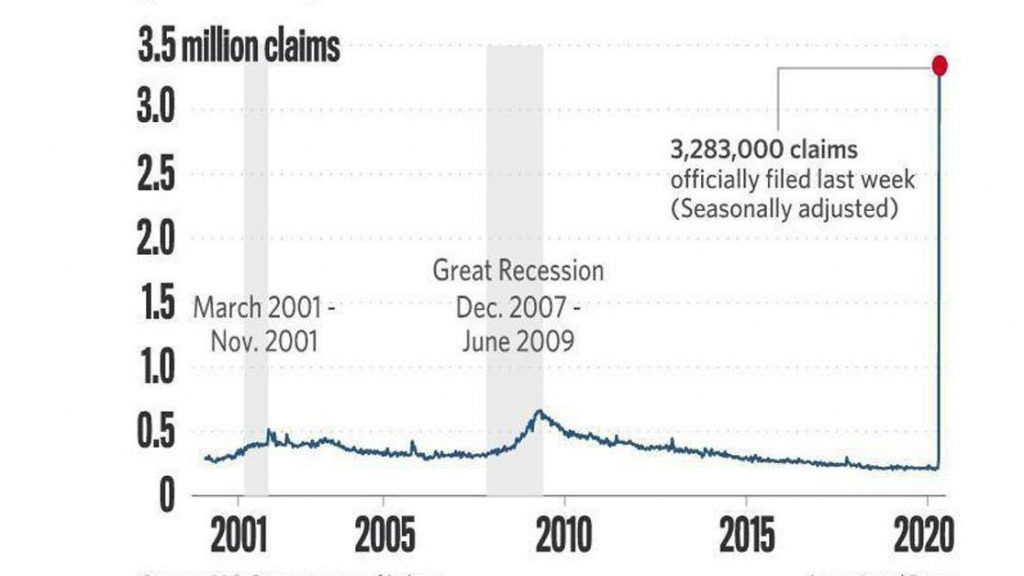

Unemployment could soon be 25-30% in America, with most businesses forcibly closed. The past nine years have been the eye of the storm. We are now entering the other side and it is going to get brutal before the clouds finally clear – which they won’t because they won’t let deflation take place until the system is already dead.

Surviving this downturn was about going long short, short long. The bounce should be anticipated, but where it goes from there really depends on consumers spending, businesses investing and replenishing supply chains. It doesn’t come from governments just injecting money into the economy, many of which hasn’t made it through to their taxpayers who will later foot the bill. My contention is that markets cannot stay buoyant once the quarterly results start coming in unless this oil glut between the Saudis and Russians is lifted along with the trade war between China and USA on top of Covid-19 disappearing in the rear view mirror allowing the economy to resume “business as usual” toward the second half of the year.

Foolhardy investors have doubled down on the knife grabbing the “discounts”. Fund managers asleep at the wheel just applied the same macro-formula to every market scenario focusing on “time in the market”. Covid-19 may not be the underlying factor, but it makes a convenient scapegoat to pop the ‘Everything Bubble’. It may not be long before we hear the rallying cries of impoverished social unrest: “Death to the Money Changers”.

3.3 million weekly unemployed claimants in America saw the Dow Jones +1000 points. 20 million more should get us back to those all time highs and Dow 30,000.

Bull Trap’s always follow initial crashes. This one brought the S&P back to 2,680 and FTSE to 5,800 around the 31.2 Fibonacci. Then we head down to S&P 1,240.

All this false propping up of Pensions, 401k’s, sovereign wealth funds rebalancing will not only be gone by mid-April but will show even deeper losses.

The hard-working average Joe or Jane will be inadvertently buying stocks through this “mandated rebalancing” that he or she has no clue is happening. Boeing shares bottomed at 90$ before rebounding to 180$ a share on the back of this rebalancing.

VIX stands near 60, SPY volume has been anaemic this last week. Once we enter April, the fund rebalancing and the accompanying FOMO (fear of missing out) driving this market higher on no real volume indicate a further drop to new lows. April will see volume pick up, volatility reach the highs again and more sell offs, bankruptcies. The 8 weeks business support grants, loans and waivers simply won’t make it to most businesses.