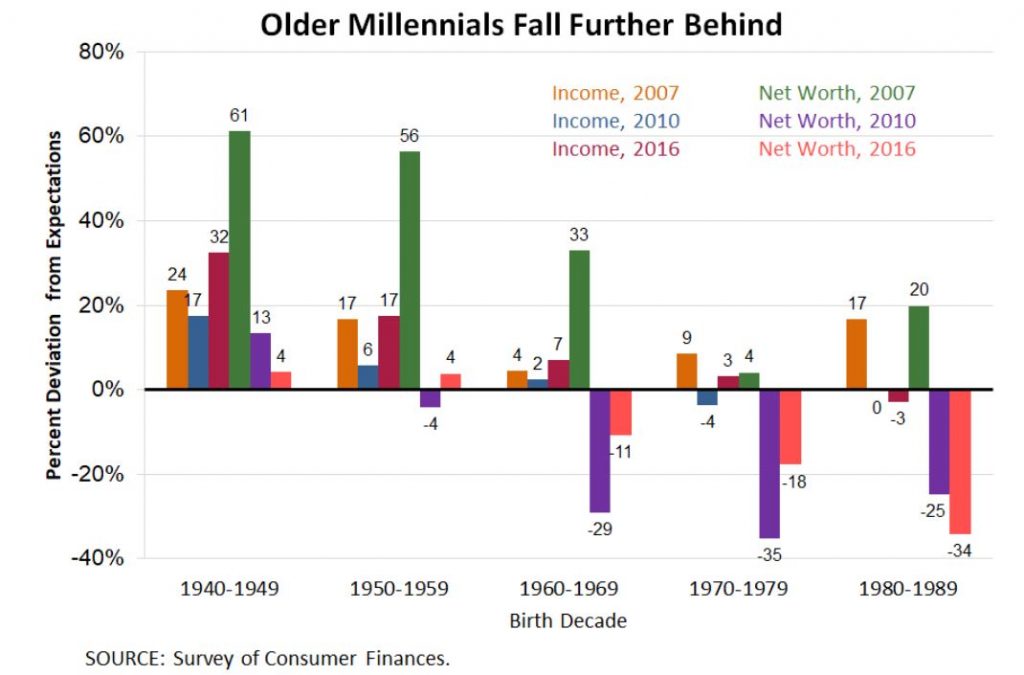

Millennials are the largest adult generation and make up the largest share (38%) of the workforce. Yet, the wealth accumulated by the median (or middle) millennial family is much lower than what we would expect based on previous generations. Because of this worrisome trend, the Centre for Household Financial Stability questioned whether a significant share of them will be able to meet long-term financial goals or if they will indeed become part of a “lost generation.”

Falling Short

Young people are struggling in record numbers to find work, leave home, and start a family, according to Pew Research. Many young Brits cannot afford to move out from their family homes. Employers have largely switched into employee-self-managed retirement programmes, doing away with the ‘gold plated’ final salary schemes.

It remains a greater leap for millennials than other generations to overcome stagnant wages that have fallen in real terms against the median house prices. This has left the average income to average house prices rising from 3.2 times annual salary in 1965 to 4.4 times 1995 and 12.2 times by 2012-13.

Such is the wage stagnation that our grandfathers could go out to work without A Levels, working in factories earning today’s equivalent £80,000 where a young couple today would struggle to pull in £70,000 between them working full time.

Perhaps the most startling finding comes from a 2017 paper by social scientists at Harvard, Stanford, and the University of California, Berkeley: economic mobility has decreased significantly since the 1940s. 90% of those born in the 1940s out-earned their parents by the time they hit 30. By the 1980s, this figure dropped to 50% among British and Americans.

Exponentially rising student debt makes college less affordable even as it has become increasingly necessary. Between 1993 and 2015, average tuition increased by 234% — when the inflation rate was just 63%. According to data from the Bureau of Labour Statistics, 46% of grads left college with debt in 1995, compared with 71% in 2015. According to the Young Invincibles data, even college grads with debt earn more than people without a degree.

Coming of Age

Millennials spent their childhood and formative years watching their parents struggle with joblessness and erratic income as a result of two recessions. All we are familiar with is the markets caused all that hardship. So, it is only natural that we don’t trust a market we know so little about.

People ought to be invested in stocks. Trouble is, we dislike the volatility and prefer the relative ‘security’ of property, bonds and even cash sitting idle in bank accounts earning a negative real return instead.

We participate less frequently in pension plans, scarred by the Great Recession, invest less and keep more than half our money in cash. Not a great long-term strategy, which is especially worrisome when combined with weak incomes and low net worth, as most of the wealth is concentrated in the baby boomer generation.

All of these make it decidedly harder for millennials to hit those traditional “adult” milestones, like having kids or buying a house.

The Ballooning Collective Debt

Longer term, rising national debt payments and increased spending on Social Security and health provisions for an aging population will inflict a tremendous financial burden on them, threatening their own prospect of receiving promised retirement benefits. Dependency ratio has gone from 2.2 during our grandparents in their working prime to over 14 dependents per working adult today.

Saddled with debt and thin pay checks, millennials are delaying purchasing cars and new homes, low mortgage rates notwithstanding. By June of this year, homeownership among under 35s fell to 34.8 percent, down from a high of 43.6 percent in 2004.

Just to complete a dismal picture, millennials will also be the victims of the irresponsible fiscal policies pursued in large part by members of the baby boomer generation. The massive budget deficits of recent years and projected needs to meet future obligations to retirees will result in a steady increase in national debt, from less than 80 percent of gross domestic product today to an estimated 181 percent of G.D.P. by 2090.

Amplified Wealth Redistribution

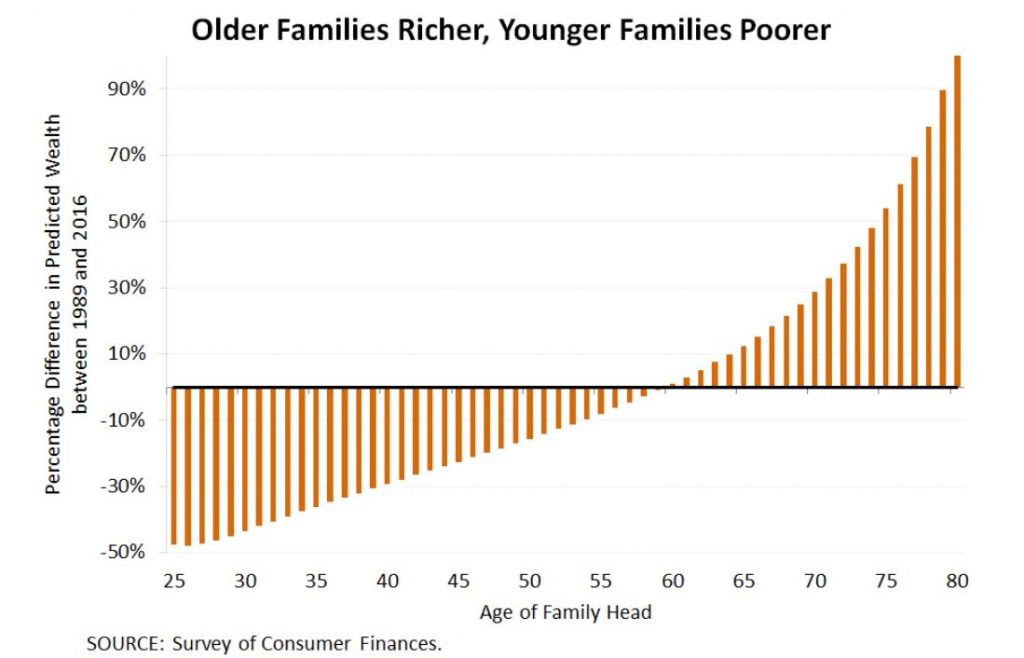

The Great Recession also amplified the trend of wealth redistribution from young to old families, which had been growing for many decades. The least wealthy 10% of households saw their real wealth rise by £3,000 between 2006-08 and 2012-14, versus £350,000 gains for the wealthiest 10%.

What happened?

Those with savings in bank and building societies watched as interest rates fell year on year to eventually turn negative.

Those families with large leverage exposure through leveraged stock market funds saw significant out performance.

While those fortunate enough to have small deposits and large mortgages could re-broke these after the crisis from 6%+ down to 2% as the Bank of England lowered the Base Rate to provide liquidity to the financial system. Relative to their equity invested, property prices rose with re-inflationary Quantitative Easing and foreign demand for UK property. Their assets rose in value, and so too did asset owner’s wealth.

Age 60 appears to be a demarcation point. Families with the household head near retirement age and older had higher expected wealth in 2016 than a family the same age in 1989. Younger families had less expected wealth in 2016 than in 1989.

Generation Z salvageable, Millennials perhaps not…

Future generations would benefit from mandatory investing classes for all high school students so they know where to invest and how to invest for the future.

For the millennials who will never benefit from this knowledge and are faced with tougher financial conditions for holding down jobs, families and building wealth than previous generations; the outlook really is bleak when all that concentrated wealth won’t be released to them until they are in their 50s or even 60s because of increases in longevity of the Boomer generation.

Not all those that wander are lost

It is evident that millennials are taking longer than previous generations to reach traditional adult milestones like gainful employment, marriage, and home ownership. Some of this is due to choice, for example no remaining stigma associated with premarital sex meaning people tend not to marry until they genuinely want to. But much of this is attributable to higher prices in real terms of property and education. Add to this, people living and working longer, sitting in jobs diminishing social mobility and promotion progression; this makes jobs less plentiful for young people and tends to make the climb up the corporate ladder longer.

However, we could stop short of saying living a few years at home or not being able to buy a home in one’s 20s or 30s necessarily means things are tougher for millennials.

You’ve never had it so good.

Harold Macmillan, British PM 1957-1963

After all, our great grandparents lived through the Great Depression, WWII and came back home to put their lives together in a world that lacked the vocabulary and willingness to talk about trauma.

The world we live in is far from perfect. But it is prosperous, statistically very peaceful (crime at near all-time lows), less racist, sexist, and homophobic than in the past.

Armed forces are voluntary and technology would have been unimaginable for their generations that has made life easier and better. We are on the verge of living in a world where even basic things like driving a car or going to the shops will be done for us.

So while we have our fair share of challenges today, the truth is every generation does. And the millennials today, while arguably have a tougher lot than some generations; is hardly the worst we have faced.

Many previous generations have become annoying with their castigations and aspersions. What softens the blow of our problems is that ours are by-and-large solvable on our own. This demanded discipline and diligent planning we have had to acquire ourselves through our 20s trying to make life work. Courtesy of the extreme mollycoddling and an expectation life would match our parents, it has stunted the normal course of our development.

When British Prime Minister Harold Macmillan addressed those gathered in Bedford with “you’ve never had it so good” in 1957, it was used to attempt to persuade the electorate that their fortunes were best served by the party in power. Maybe today, we are best served by ourselves undoing the complacency that the baby boomer’s prosperity has handicapped us with. In decadence lies our undoing, in diligence hard work and a little dose of perspective, we can find our generation’s salvation.