Now that the “Chinese stock ban” cat is out the bag, there’s a good chance Trump will follow through on this threat eventually if an acceptable trade deal is not reached. The SEC has failed, alongside the NASDAQ to prevent foreign companies fleecing US investors for 10 years. As the trade war escalates, Chinese firms may lose access to US Capital Markets. Stricter rules and auditing are needed to provide the same level of scrutiny that American companies receive. But too many hands in the pie for the Chinese Communist Party will ultimately block adequate regulation. This leaves Trump with few options if the October Chinese trade delegation to Washington collapses.

“The argument for barring China from the US capital markets is simple but compelling: Why should the United States government allow U.S. Capital Markets and the American people to fund the world’s most powerful adversary of freedom which threatens the very markets it participates in?” James Gorrie, author of ‘The China Crisis.

China has been abusing the system for decades by faking the financial health of listed companies, to the detriment of investors and the capital markets.

China’s Stock Market Fraud

Manipulating stock markets is nothing new to China. In fact, it’s business as usual.

Since 2008, Chinese companies accessed U.S. stock markets through reverse-takeovers in which they bought idle or failing listed companies and automatically achieve that status – even if they completely alter the business’s sector or output. This isn’t necessarily bad nor illegal, but predatory behaviour to bestow unknown Chinese companies instant credibility. What’s more, many attracted investors with virtually no oversight as to the viability of their operations or the veracity of their accounting.

The level of China’s fraud is staggering. According to documentarian Jed Rothstein in his 2018 film “The China Hustle,” up to $50 billion or more was invested in fraudulent companies listed on the New York, American, and Nasdaq stock exchanges.

But how could corporate fraud be so prevalent under the heavy US regulations? The reality is, if the management wants to commit fraud, the auditors are unlikely to find it.

Chinese deception is not limited to America. Various manifestations of pump-and-dump schemes have been ongoing in Shanghai and Hong Kong stock markets for years. A cycle of artificially inflated valuations, luring in unsuspecting Chinese investors by the millions, leveraging themselves to the hilt to participate. All the while insiders, often Chinese Communist Party members, sell at the market highs, reaping billions in ill-gotten gains.

Removing access to American investors

For these reasons, U.S. lawmakers such as Senator Marco Rubio (Republican-Florida) proposed banning $49.5 billion of U.S. pension fund money, known as the iFund, from being invested in Chinese companies. That would send a clear message to China by halting a considerable amount of investment cash from going into mainland companies.

This could be followed up with larger hits to Chinese capital needs as the federal government pension fund refusal to invest the $578 billion in the MSCI All Country World Index, of which Chinese firms comprise 4% of that index, expecting to double over the next few years.

Since 55% of all new U.S. listings in 2019 have been Chinese companies, without access to U.S. capital markets, mainland China firms would be scrambling for the capital they need to survive.

The geopolitical consequences would be immediate. U.S.–China relations would sour further and push the trade war further into the future. However that may be the price that needs to be paid.

Chinese Come to America

This comes before the Chinese trade delegation is due to visit Washington October 11TH.

“Washington should understand that the implications for the trade imbalance are the opposite of what they want,” Michael Pettis, finance professor at the Guanghua School of Management at Peking University, said in an email.

Many Chinese start-ups have chosen to list in the U.S. for a boost to their brand and access to U.S. dollars.

Lower Growth for American portfolios

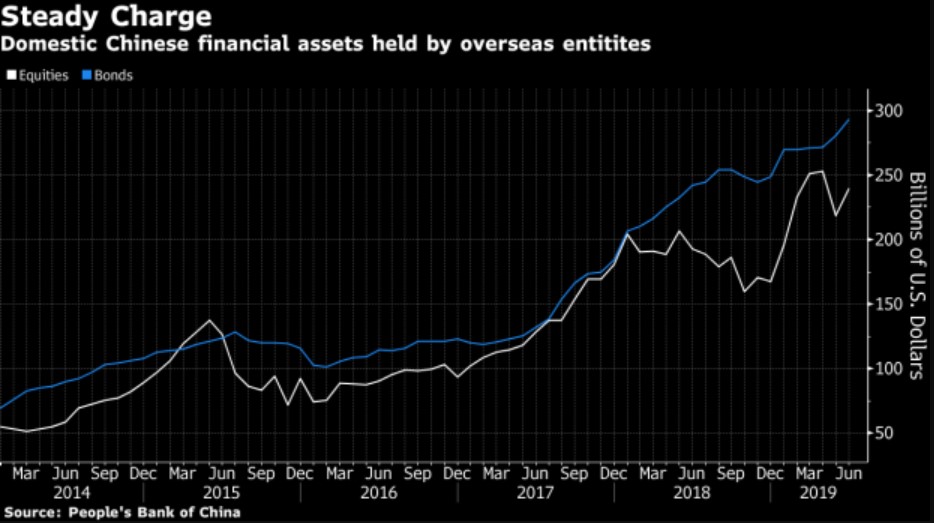

Global stock index provider MSCI has also been gradually adding some mainland Chinese A-shares to its key emerging markets index, and more than $1.9 trillion in assets were included in the benchmark index as of the end of 2017.

In April, the Bloomberg Barclays Global Aggregate Index started adding Chinese bonds. J.P. Morgan also announced it would include Chinese debt in its benchmark bond index early next year.

Full inclusion of Chinese assets in these stock and bond indexes would mean that many Americans would be indirect investors in Chinese capital markets through mutual funds and other widely held investment products.

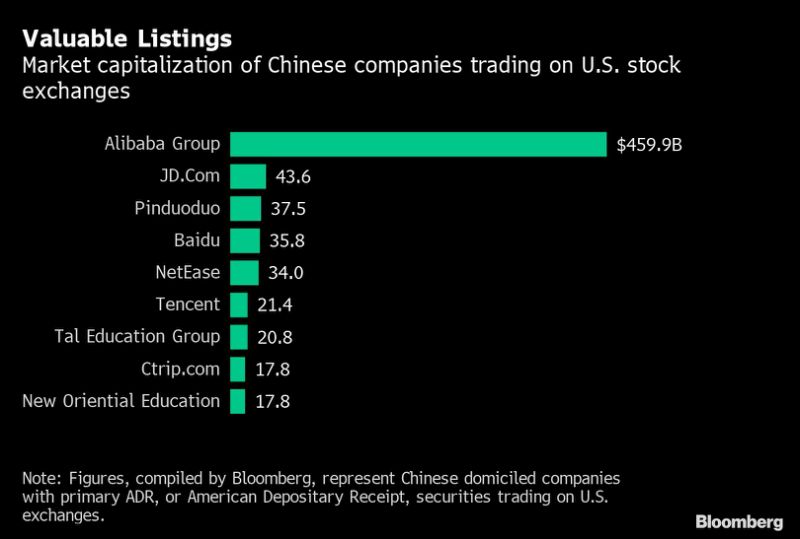

More than 200 Chinese companies, including giants like Alibaba, have raised tens of billions of dollars on U.S. capital markets through listings or American Depositary Receipts, according to an August report by analysts from research firm Gavekal Dragonomics, Andrew Batson and Lance Noble.

If this trend continues, regardless of how slowly, being prohibited from China would mean “U.S. banks, U.S. mutual fund companies will be at a clear disadvantage to their global competitors,” Ning Zhu, Tsinghua University.

If such U.S. investments were banned, American investors would miss out on what many analysts expect will be a long-term growth story.

In favour of removing the fraud and transparency concerns

Investment restrictions in place would be designed to reduce exposure to excessive risk due to lack of regulatory supervision of Chinese companies: a decade of access and no real repercussions for gross malfeasance.

It is amazing that the NASDAQ and the SEC allow companies that don’t operate in the USA access to US capital markets without strict oversight from a certified audit like stateside companies require. They are ripping billions off US investors in the Options market very stealthily. The SEC roasted them on Friday with a warning shot and it is about time they cottoned on.

Beijing may never allow Chinese US listed books to be fully audited. There are too many Oliver hands extended from the Chinese Communist Party.

The only real-world plan to delist was already introduced by Marco Rubio and others. The bill is an amendment to the Sarbanes Oxley act and had a 2025 date for compliance, but with no grandfather provisions ever adopted.

Chinese firms needs the stable institutional inflows

Foreign investment in mainland-listed Chinese stocks remains limited, even as Beijing tries to open its markets further to overseas investors. Since the domestic stock market is dominated by retail investors, authorities are trying to attract more stable inflows from institutional investors.

Mainland China’s capital markets are among the largest in the world, but often fall short of the governance and liquidity levels of more developed markets.

Last week, FTSE Russell decided not to add China to its widely tracked government bond index due to issues such as lack of trading activity and long settlement periods, according to Reuters.

Analysis by New York-based research provider Rhodium, released in the fall of 2018, also found that 65% of Chinese companies included in the MSCI emerging markets index at that time were ultimately controlled by the state. The presence of SOEs (state-owned enterprises) is not a phenomenon unique to China but common to many emerging markets.

All Red

All Chinese listed shares may retrace some of the losses from Friday’s fake Bloomberg delisting headline. The report stated officials had discussed limiting US investment in China and the possibility of delisting them from NASDAQ. Large players may re-enter their positions in Chinese U.S. listed stocks, with American epository receipts of several major CHinese companies rising after Trump administration pushed back against the false claims. For the time being, its an empty threat and non-event.

Bloomberg was irresponsible to run a story with no details, dates or who said what and when. It looked almost well timed to create more market uncertainty for increased volatility, creating more arbitage opportunities for market manipulators.

It shouldn’t be ruled out, “all cards are on the table”. And after all, for the man who took a games show joke to run for President and made it a reality, we shouldn’t dismiss this possibility in a trade war that has become personal between Trump and Xi.